Quickly Compare Home Reversion Quotes

Get special deals from top home reversion providers. Best quote guaranteed or £750 for you!

Start Your Home Reversion Quote

Simply select your property type below to get started.

Quickly Compare Home Reversion Quotes

Get special deals from top home reversion providers. Best quote guaranteed or £750 for you!

See how much you can release as tax free cash from your home

Free quotes from the leading home reversion providers

Get February 2026's best deals with exclusive rates and offers

Why over 100,000 people trust this service

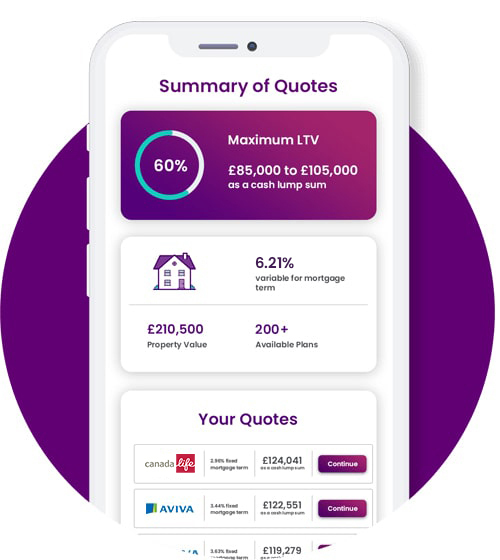

Unlock the UK's top quotes

Get exclusive rates and offers from leading UK home reversion providers.

Instant result

Find out instantly how much you could unlock with our free home reversion quote service.

Free advice on plans

Enjoy free initial advice from your selected home reversion adviser.

Get the best deals around

Find the best deals for you which can include preferential deals, cashbacks and free surveys.

Testimonials

Frequently asked questions

How does a home reversion plan work?

A home reversion plan is a type of equity release plan that enables you to sell all or part of your home in exchange for a cash lump sum. Once you have decided how much of the property you wish to sell, you will be paid the agreed money by the home reversion company to spend as you wish. Remember, the amount of money you are paid for this percentage of your home will be less than the market value as you will be living in it rent-free for the rest of your life, or until you move into long-term care.

Unlike a lifetime mortgage, no interest is charged on your plan and the percentage of your home that you still own will not change, regardless of what happens to house prices in the future. When your home is eventually sold (usually when you pass away or move into long-term care) then the money is divided between the Home Reversion company and you / your estate.

For example, if you sell 75% of your home to the home reversion company for a cash lump sum, then they will retain 75% of the final selling price, and your estate receives the remaining 25%.

Will I still own my home?

How much can I borrow with a home reversion plan?

The maximum amount that a home reversion company will lend to you is usually decided by:

- The age of the youngest homeowner (you need to be 65 to qualify)

- How much your home is worth (the minimum amount is £80,000)

- How much you are prepared to sell (up to 100% of your home’s value can be sold)

- Your health or lifestyle may allow you to secure a higher market value for your home.

Generally, the older you are, the higher the amount of tax-free cash you will be eligible to receive in exchange for a percentage of your home’s value.

Can I guarantee an inheritance for my family?

Yes, home reversion plans are a good way to unlock a cash lump sum from your home whilst guaranteeing an inheritance for loved ones. If you choose to sell 50% of your home to a Home Reversion company, then you or your family are guaranteed to receive the other 50% of the final selling price when your home is sold on your death or you go into long-term care.

Interest does not apply to a home reversion plan, so you have absolute peace of mind that a fixed percentage of your property’s value will be available as an inheritance for your loved ones when you pass away or move into long-term care.

Three ways to get started

@2026 Equity Release UK

Equity Release UK is a trading style of Comparison UK Limited. We do not provide financial advice. Instead, we connect you to fully regulated equity release specialists, who will help you compare the best quotes from the UK’s leading providers. See our Terms & Conditions for more information.

Client testimonials refer to the service provided by our selected equity release advisers. To protect the privacy of clients, names and identifying details have been changed.

Initial advice is free - more information on fees can be found in our Terms and Conditions.