Quickly Compare 200+ Drawdown Equity Release Plans

Get special deals from top equity release providers. Best quote guaranteed or £750 for you!

Start Your Drawdown Equity Release Quote

Simply select your property type below to get started.

Quickly Compare 200+ Drawdown Equity Release Plans

Get special deals from top equity release providers. Best quote guaranteed or £750 for you!

See how much you can release as tax free cash from your home

Free quotes from the leading equity release providers

Get February 2026's best deals with exclusive rates and offers

Why over 100,000 people trust this service

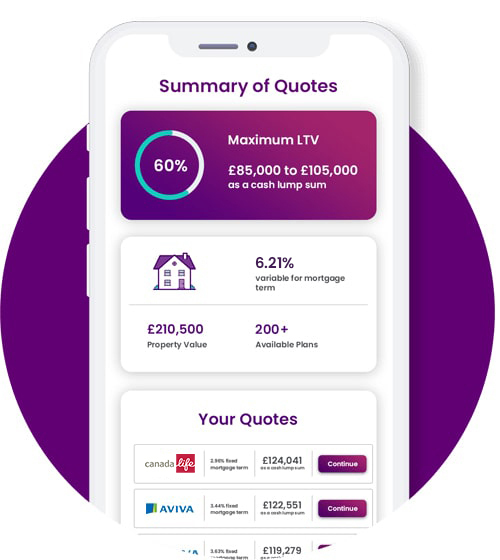

Unlock the UK's top quotes

Get exclusive rates and offers from top UK drawdown equity release providers.

Instant result

Find out instantly how much you could unlock with our free drawdown equity release quote service.

Free advice on plans

Enjoy free initial advice from your selected drawdown equity release adviser.

Get the best deals around

Find the best deals for you which can include preferential rates, cashbacks and free surveys.

Testimonials

Frequently asked questions

What is a drawdown equity release plan?

How much can I borrow?

How much does it cost?

The amount of interest you are charged on your drawdown lifetime mortgage plan depends on how much money you unlock from your home, the interest rate/s applied to your loan, and for how many years you have the plan.

Drawdown equity release plans (also known as drawdown lifetime mortgages) can save you money compared to a standard equity release plan, because you are only charged interest on the money that you ‘draw down’ from your available facility. You don’t need to make any monthly repayments on your plan as the interest is rolled up on a monthly basis and added to your original loan amount.

Will I still own my home?

Three ways to get started

@2026 Equity Release UK

Equity Release UK is a trading style of Comparison UK Limited. We do not provide financial advice. Instead, we connect you to fully regulated equity release specialists, who will help you compare the best quotes from the UK’s leading providers. See our Terms & Conditions for more information.

Client testimonials refer to the service provided by our selected equity release advisers. To protect the privacy of clients, names and identifying details have been changed.

Initial advice is free - more information on fees can be found in our Terms and Conditions.